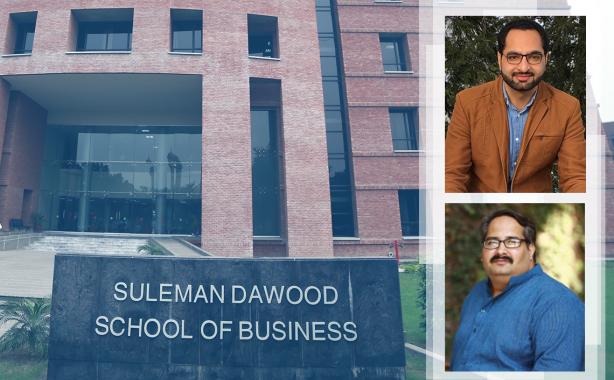

Pro-cyclical Effect of Sovereign Rating Changes on Stock Returns: A Fact or Factoid? Research paper by Yasir Riaz, Phd candidate at Suleman Dawood School of Business (SDSB) and his co-authors, Dr. Choudhry Tanveer Shehzad, Associate Professor, SDSB, LUMS, and Dr. Zaghum Umar, Assistant Professor, Zayed University, has been accepted for publication in Applied Economics, an "A" rated journal by ABCD. Paper is available here.

This achievement on the part of a PhD candidate reflects not only the high standards of rigor embedded in the research culture at SDSB but also the collaborative spirit, shared by the community of PhD students and faculty members for the pursuit of common intellectual interests.

The paper examines the effect of changes in sovereign credit ratings and their outlook on the stock market returns of European countries at different phases of the business cycle and shows that stock markets react more negatively to rating downgrades in recovery phases and more positively to rating upgrades in contractionary periods.

“This paper extends the literature that has shown a significant effect of sovereign rating and outlook changes on stock markets as well as the cyclical nature of sovereign rating changes. It investigates if the effect of these changes (whether pro-cyclical or counter-cyclical) on stock returns is pro-cyclical. We have tried to improve upon the technique for the calculations of abnormal returns. We used the Fama-French four-factor model instead of CAPM and regional factors instead of global factors. However, the paper does not find evidence of the pro-cyclical effect of sovereign rating and outlook changes on stock returns,” commented Mr. Riaz on the accomplishment.

“This paper is a part of my doctoral thesis research conducted within SDSB. For this, I would like to thank Dr. Choudhry Tanveer Shehzad, my thesis supervisor, for his unconditional support, guidance, and mentorship throughout the project and Dr. Zaghum Umar for his valuable suggestions to improve this paper. This project would not have been possible without the financial support from LUMS during the PhD programme,” added Mr. Riaz.